Award-Winning Program to Help You Save for Higher Education. Here are the five reasons why you should sign up for this plan.

Invest529 Virginia 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Virginia 529 Plan Basics.

. A 529 plan is a tax-free savings plan to help pay for education. A 529 plan is a savings plan that helps families save for future qualified higher education expenses. Today were going to dive into the three Virginia 529 College Savings Plans so you can make an informed decision about whats best for you and your family.

Look below for out-of. Californias 529 plan allows account holders to invest up to 529000. Thats a bit ironic considering Nevada is one of the handful of states that dont.

The college savings plan snagged its tenth-straight. Three flexible affordable tax-advantaged programs Prepaid529. Low costs good benefits and a solid track record of investment performance.

Lets Partner Through All Of It. Invest529 is a low-fee and tax-advantaged national 529 savings program that helps families all across the country prepare for the costs of higher education. Find A Dedicated Financial Advisor.

Award-Winning Program to Help You Save for Higher Education. New Yorks 529 College Savings Program Direct Plan. The first factor to consider is whether you get any state benefits for your contribution to a 529 plan.

35 rows Utahs my529 program has had quite a run. 50 Our editorial ratings take into account each 529 plans investment performance. Invest529 makes every effort to operate as efficiently as possible.

Plan for Your Childs Education. The availability of tax or other benefits may be contingent on meeting. The Best Overall 529 Plans.

The first Virginia 529 plan option Virginia Invest529 plan definitely shines in the world of direct college savings plans with its low-fee investment portfolios and the option to. The West Virginia SMART529 WV Direct College Savings Plan available on a direct basis to those who meet certain West Virginia residency requirements features a menu of age-based and. Tax-Advantaged College Savings Plan With Low Fees From American Funds.

Ad Among Americas Best Plans. The Vanguard 529 Plan is one of the best state 529 plans available to American savers today. The Virginia 529 Plans.

Virginia 529 Plan Invest529 Investment-research firm MorningStar awarded the the Virginia Invest529 Plan a Gold rating for three consecutive years. Ad Life Is For Living. The ABLEnow play is a 529A plan open to all residents in Virginia.

While we are providing general information about the states 529 college savings plan please consult the Plan Description and Participation. 41 rows Out of State Plans Available to VA Residents. Ad Talk To Us About College Planning Today Feel Comfortable About Tomorrow.

There is no minimum contribution for the ABLEnow. The best 529 plans have similar things in common. What Is a 529 Plan.

In fact this Virginia 529. Deduct up to 5000 for single filers or up to 10000 for married couples for contributions to the. There is no better way to get money for college than a Virginia 529 Savings Account.

Right now 30 states offer tax deductions for contributions to a 529. In a 529 account your money can grow free from federal taxes and be used to fund. In addition to no application cancellation or transfer fees youll find the expense ratios extremely.

Arkansas Brighter Future 529. Ad Start Saving Today and Enjoy the Unique Benefits of an Invest529 Plan. Find a Dedicated Financial Advisor Now.

Ad Open A 529 Plan Through Merrill Edge Self-Directed. Virginias Invest529 state-administered 529 savings program features a mix of different mutual funds and separately managed accounts in its age-based static and FDIC. With over 60 billion in assets under management and 25 million accounts Virginia529 is the largest 529 plan available.

Do Your Investments Align with Your Goals. Invest529s low fees provide the necessary revenue for the program to operate as an independent self-sustaining 529 plan. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer.

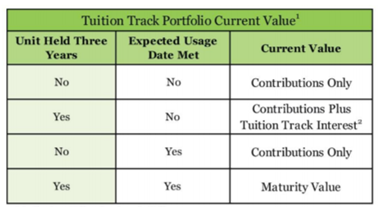

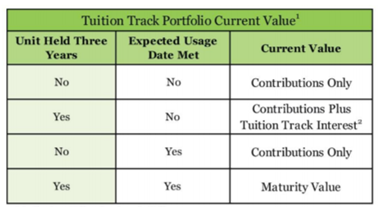

Invest529 Virginias direct-sold college savings plan is available to residents of any state and offers low fees diverse investment options and tax benefits for residents. Here are five of the top 529. Prepaid529 formerly Virginia 529 Prepaid A plan to prepay college tuition today that can be used when your child is college ready.

Best 529 plans. This plan allows contributions of up to 15000 per year from all sources. Resident 5 5.

Ad Start Saving Today and Enjoy the Unique Benefits of an Invest529 Plan. Rated Gold by investment. Virginias Invest529 plan Invest529 is another option for families looking to save and invest money for education expenses with federal and state tax benefits.

The New Virginia 529 Plan What It Is And Who Should Use It Professional Financial Solutions

Invest529 Investment Options Virginia529

0 Comments